Whether you’re a tenant or a homeowner, you’ve probably heard of civil liability insurance for homes, though its details might remain unclear. What does it cover? Is it mandatory? How much does it cost? Let’s break it down.

What does private civil liability cover?

Essential yet minimal coverage

Home insurance policies always include civil liability coverage, which protects you when you’re responsible for physical or material damage caused to others or their property. This is commonly referred to as "third-party coverage" meaning you’re insured for harm caused to others.

Here are some examples:

- Accidental injuries and damages: If you accidentally injure someone or damage their belongings, even outside your home. For instance, if your dog knocks over an elderly person on a walk and they claim compensation for their injuries, your private civil liability insurance can cover the costs.

- Tenant responsibilities: If a fire or water damage starts in your rented home and spreads to your neighbours or shared spaces, your fire and water damage liability coverage will handle the resulting costs.

What’s not covered

There are situations where civil liability insurance doesn’t apply:

- If you suffer personal injuries.

- If the damage is caused intentionally.

- If the damage is caused by restricted dog breeds (e.g., Rottweilers as defined in Article 211-12 of the French Rural Code).

- If the damage is linked to high-risk activities (e.g., hunting or extreme sports).

- If the damage is caused by a motor vehicle (this is covered under auto insurance).

Enhancing coverage with comprehensive home insurance

While civil liability is crucial for protecting against damage caused to others, it’s not enough to safeguard your home and belongings.

Comprehensive home insurance offers a more secure option by covering:

- Your property and belongings against risks like fire, theft, or natural disasters.

- Civil liability for damages caused to others.

Get more tips from Sarah, our insurance expert, for a clearer understanding.

Is civil liability insurance mandatory?

Yes, in many cases:

- Tenants: It’s required that tenants have rental liability coverage for risks like fire, water damage, and explosions.

- Owners of co-owned property: Whether you live there or rent it out, liability coverage is mandatory.

Exceptions: Individual homeowners are not legally required to have liability insurance but are strongly advised to, as uncovered damage to third parties can result in significant costs.

Dans la majorité des cas, oui !

- En tant que locataire

- En tant que propriétaire d'un logement en copropriété : propriétaire occupant mais aussi propriétaire bailleur (propriétaire non-occupant)

Seuls les propriétaires de maison individuelle n'ont pas l'obligation de s'assurer au titre de la responsabilité civile habitation. Néanmoins, cela reste fortement recommandé car les dommages peuvent représenter des coûts importants.

GOOD TO KNOW:

Technically, civil liability is not compulsory for tenants, who are only required to take out tenant's risk insurance covering the property against the risks of water damage, fire and explosion. In practice, all insurers, including Luko by Allianz Direct, systematically include ‘recourse against neighbours and third parties’ cover, which corresponds to civil liability.

Risks of not having civil liability insurance

- Financial Risks: Without insurance, you would bear the full financial burden if you are found liable for damage. These costs can run into millions. For example, if an old, faulty power strip in your home causes a fire that destroys an entire building, you’d be responsible for rebuilding the property and compensating neighbours for their lost belongings.

- Legal Risks: Civil liability insurance is mandatory for tenants and co-owners. Tenants: Your landlord can arrange insurance on your behalf and add the cost to your rent, or even pursue eviction if your lease includes such a clause. Co-owners: The condominium association can take legal action if you fail to comply.

How to get a civil liability certificate

The easiest way is to purchase home insurance online, where your certificate is issued immediately upon subscription. Traditional insurers may send the certificate by mail, which can be inconvenient if you need it urgently.

Why choose the Luko by Allianz Direct Minimum Legal offer?

Luko by Allianz Direct’s Minimum Legal plan ensures you meet your legal obligations while offering reliable coverage for common incidents, all at a fair price.

- Save on premiums: Luko by Allianz Direct is, on average, 15% cheaper than traditional insurers for equivalent coverage. As an online provider, we keep costs low without sacrificing service quality.

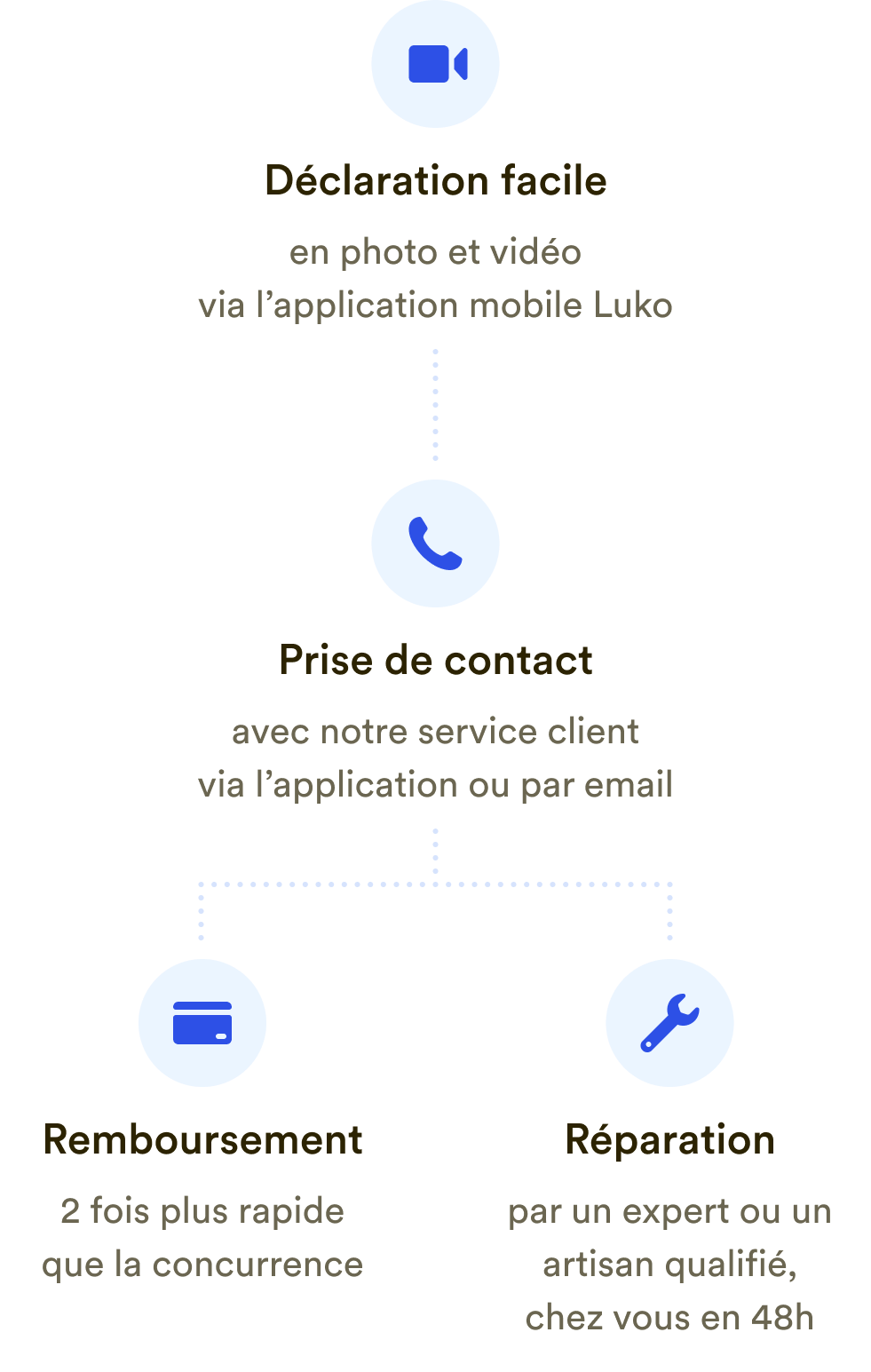

- Fast claims processing: Tools like video assessments and instant payments allow us to process claims twice as fast as the industry average.

- Simple and clear: Subscribe in 2 minutes, with straightforward explanations of what’s covered and what’s not.

Switch to Luko by Allianz Direct for a hassle-free, cost-effective insurance experience.