Keep cool by saving energy (and money !)

Our best tips for keeping the heat off this summer (and saving money at the same time).

By Luko by Allianz Direct

It is an obligation to insure your electric scooter. Discover here how

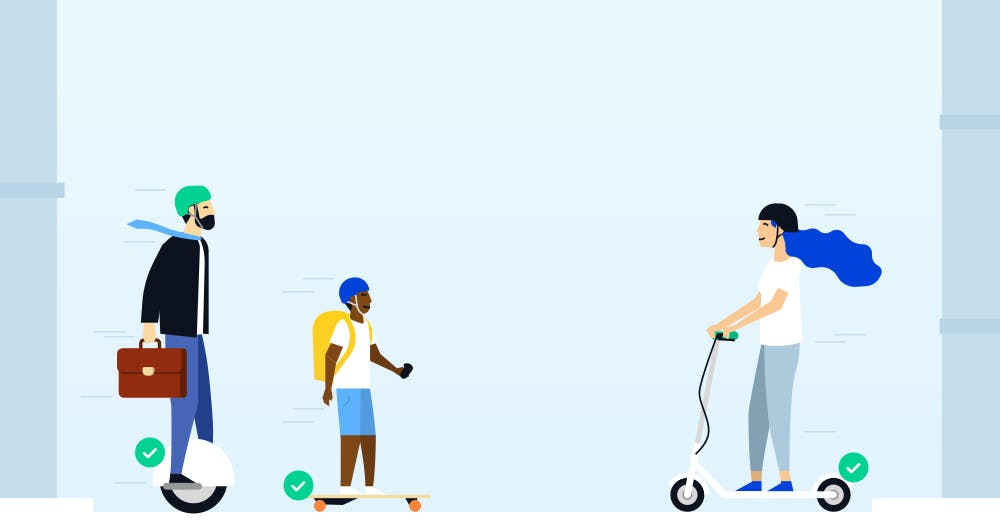

You can’t have missed it: electric scooters and other small electric devices have invaded our lives those past months.

Just as practical as they are dangerous, accidents and damage are exploding, which raise the issue of insurance. Who is covered? Who pays? How to protect yourself?

Luko by Allianz Direct takes a closer look at the situation 🔎

Like cycling, it is highly recommended to wear a helmet in an electric scooter. Indeed, your car can go up to 25km / h. In addition, think of the other drivers with whom you could collide –they do drive much faster. At these speeds, accidents can be serious.

We strongly recommend protecting yourself with a helmet. And yes, the insurers take this factor into account in their compensation.

In principle, yes. The French Federation of Insurance reminds that electric scooters must, as a motorized vehicle, have liability insurance.

From 4 € / month, the electric scooter insurance of Luko by Allianz Direct offers you, among other things, something which is of a compulsory civil liability.

However, to this day, this obligation is not enforced nor sanctioned by the legislator. Especially since the law is far from clear as to the circulation of these machines. Electric scooters are currently tolerated on sidewalks (max 6km / h) and on the bike path (max 25 km / h), but a law should soon prohibit sidewalk.

From…

my civil liability?

my auto insurance?

my home insurance?

Hmm ... none of those three really! This is a blurry topic.

Electric scooter insurance is not included in the liability of your home insurance. Indeed, this type of vehicle runs at more than 4km / h, which makes it an exclusion.

Regarding auto insurance, it's also unclear. The electric scooter is currently part of the category of NVEI (New Individual Electric Vehicles) and is not registered. It therefore cannot depend on this type of contract in principle. Nevertheless, some insurers currently go with this insurance category.

To simplify your life, we made it a product apart at Luko by Allianz Direct.

Subscription’s easy, 100% online. And you can terminate it whenever you want.

Would you like to receive our pieces of advice and tips ?

Subscribe to our newsletter to get the best of Luko in our mailbox.

You will find several prices on the market when looking to insure your electric scooter. They depend on what you want to cover.

All insurance offers for an electric scooter include civil liability. This one allows you to cover the damages that you may cause to a third party, or the car material (from 8 € / month at Luko by Allianz Direct)

In contracts, this option is mostly optional, and leads to additional costs.

Our insurance covers you and your little racing car on the following cases:

The payment is monthly (not annual), so you are as free as when you drive your electric scooter!

Any question about the insurance of electric scooters and NVEIs? We are at your entire disposal on the chat, by email or by phone 💌

Linked articles

Keep cool by saving energy (and money !)

Our best tips for keeping the heat off this summer (and saving money at the same time).

By Luko by Allianz Direct