Want to know more?

4 reasons to get a GLI

An unpaid rent insurance, also called GLI for Garantie Loyers Impayés, protects your rental income and allows you to :

- Not be financially impacted by late or non-payment of your rent.

- Delegate the debt collection / eviction procedure to our team of experts.

- Provide you with legal protection if necessary.

- Cover you in case of damage to your real estate property.

In short, the GLI is much more reliable and efficient than other types of covers (physical guarantor, State Visale guarantee, bank guarantee) and, icing on the cake, the insurance premiums are deductible from your property income in France, so no more reason to hesitate.

Did you know? You are not allowed to combine an unpaid rent insurance with a physical guarantor unless your tenant is a student or an apprentice.

How to subscribe?

1. Apply for unpaid rent insurance

Fill in your request online in a few simple steps and in less than 5 minutes, you will be able to know immediately if the profile of your next tenant is eligible for our unpaid rent insurance and we will be able to proceed to the verification of their documents.

2. We check the tenant's documents

Luko by Allianz Direct systematically checks the tenant's documents before activating your protection: we check all the supporting documents to certify the information provided and we also analyze the professional situation, the income, the savings and the liquid assets of the tenant or his/her parents with a maximum effort rate of 40%.

This allows you to avoid any unpleasant surprises in case of unpaid rent: the case will be 100% taken care of by Luko by Allianz Direct.

3. You are protected from any unpaid rent

The GLI insurance is active as soon as you sign your contract and you are reimbursed within 30 days in case of unpaid rent, without deductible nor waiting period.

Verification of the tenant's documents

Luko by Allianz Direct systematically verifies and certifies your tenant's documents before activating your unpaid rent insurance. This avoids any reconsideration of the tenant file in case of unpaid rent: you will be reimbursed within 30 days no matter what happens.

Effort rate calculation

Our platform automatically calculates the total amount of the tenant's resources by taking into account all the tangible elements (not only the salary) at our disposal: the tenant's salary, bonuses, allowances, savings, property income, etc.

We compare it to the amount of the rent (including charges) to obtain the famous effort rate, expressed as a percentage. This allows us to determine if your tenant is eligible for a GLI.

Automated file analysis

Our platform performs several actions in an autonomous way on the documents of the tenant:

- Verification of document conformity via our OCR (Optical Character Recognition) technology;

- Scanning and identification of key elements;

- Study of the concordance with the information provided by the tenant.

Certification of the tenant by our experts

At the slightest alert, our operators are asked to certify the documents provided by the tenant, in order to avoid the most common frauds:

- Falsification of documents.

- Wage garnishment.

- Incorrect income tax return.

- Concealed judicial liquidation (for non-salaried workers).

Which tenant profile to accept?

Our offer allows you to accept all types of tenant profiles. Luko by Allianz Direct does not limit itself to permanent contracts.

It is not the professional situation that is important to us, but the ability of the tenant to pay the rent. We therefore cover tenants on fixed-term contracts, self-employed people, freelancers, cross-border workers, expatriates, and many other tenant profiles that are too often put aside:

✔️CDI ✔️CDD ✔️Interim ✔️Student ✔️Apprentice ✔️Retiree

✔️Business owner ✔️Freelancer ✔️Independent contractor

✔️Military ✔️Civil servant ✔️Expatriate ✔️Border worker

My tenant stops paying rent

It's very simple, if you haven't collected your rent or part of the rent by the date originally stated in the lease, report your unpaid rent within a maximum of 30 days from the Luko by Allianz Direct mobile application (from the date written on the lease) and for each unpaid month.

The next steps:

- As soon as we receive the completed form, your unpaid declaration is examined by our unpaid service.

- We get in touch with your tenant to find out about their situation.

- We accompany you on the first steps to take yourself and provide you with letters templates and reminders for the formal notices.

Then, 2 possibilities:

Scenario 1: Your case settles itself

It was a misunderstanding, an error, an oversight or a one-time problem with your tenant. In this case, the file is closed.

Scenario 2: The unpaid amount you reported is confirmed

Within 30 days, we provide a compensation of the amount of the rent, charges included. We also set up a repayment schedule with your tenant.

What happens next?

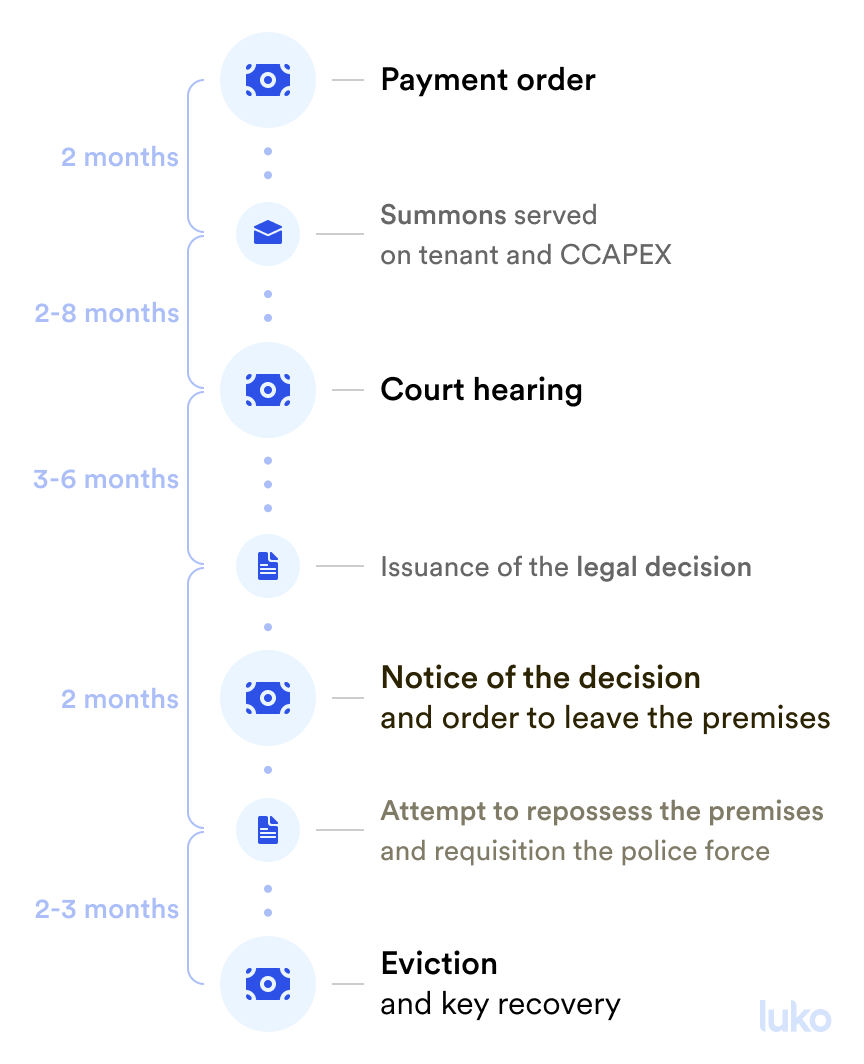

- If the unpaid amount becomes recurrent, we take charge of all the steps concerning the eviction procedure (see diagram below) by informing you of the evolution. All costs at our charge.

- You are compensated every month for the amount of the rent until the tenant settles their debt, leaves the premises or is evicted.

Example: If your tenant is supposed to pay the rent on May 5 (the date on the lease), you have until June 5 to report us the non-payment. If, for example, you report the arrears on May 10, you will be compensated for the amount of rent at the end of May. If you report the arrears on June 2, you will be compensated at the end of June.

Luko by Allianz Direct's handling of the eviction procedure

- If the unpaid debt becomes recurrent, our bailiff issues a payment order to the tenant. The tenant now has a maximum of 2 months to pay the debt indicated on the summons.

- Two months later: if the debt is not paid by this date, the file is sent to the lawyer for the tenant to be summoned to court;

- 2 to 8 months later: the hearing takes place.

- 3 to 6 months later: the court decision is obtained and an order to vacate the premises is sent to the tenant. He/she has up to 2 months to leave the accommodation.

What we don't do

- We do not cover unpaid rents in case of non payment of the security deposit by the tenant.

- We do not cover files with a lease that doesn't include a cancellation clause (clause résolutoire).

Complete your landlord coverage

To complete your protection and that of your rental investment, we also advise you to take out a landlord insurance (PNO).

Compulsory for properties located in a condominium, it completes the tenant's home insurance (also compulsory) by covering, for only a few euros per month, your civil liability as well as your property in case of damage involving your responsibility as a landlord.

It also allows you to cover the property between two tenants, in case of vacancy, when it is no longer covered by the home insurance of a tenant.

Finally, it takes over in the event of default of the tenant's insurance or of a compensation cap of the latter.

Want to know more? Go to our PNO offer.